HOW TO LINK YOUR PAN CARD & AADHAR CARD ONLINE – MANDATORY FROM 1ST JULY

1st July is not deadline to link PAN with Aadhar Card but it will be mandatory.

www.sachkaro.blogspot.com

There is a mad rush to link Aadhar number with permanent account number ( PAN) on the income tax website before July 1. People have even found the website crashing.

Many think if they don't link their Aadhar with their PAN before July 1, their PAN will become invalid.

Well, that's true but not as many understand it.

The linking will become mandatory from July 1, and it's not mandatory to link before July 1. If you are not able to link it before July 1, your PAN will not become invalid automatically. After July 1, the linking will become mandatory and the government may declare a date after which the PAN not linked to Aadhaar will become invalid. The government has not declared that date yet.

This is what Section 139AA, Income-tax Act says: "Every person who has been allotted permanent account number as on the 1st day of July, 2017, and who is eligible to obtain Aadhaar number, shall intimate his Aadhaar number to such authority in such form and manner as may be prescribed, on or before a date to be notified by the Central Government in the Official Gazette: Provided that in case of failure to intimate the Aadhaar number, the permanent account number allotted to the person shall be deemed to be invalid and the other provisions of this Act shall apply, as if the person had not applied for allotment of permanent account number."

It clearly says that the date "on or before" which Aadhaar and PAN have to be linked has to be notified by the Central government.

From July 1, PAN must be linked to Aadhaar

But since the linking is mandatory from July 1, you will need to quote Aadhaar number in the application form for allotment of a new permanent account number and in the return of income.

Here's how to link it

The IT department has made provision for assesssees to link their PAN to Aadhaar on the efiling portal. If you have Aadhaar and PAN card and you haven't linked it yet, here's help.

Link

Visit the income tax e-filing portal at

https://incometaxindiaefiling.gov.in/

and enter your user id and password to access your profile. A new user can register on the portal by entering basic registration details such as PAN, name and date of birth.

Update Aadhaar

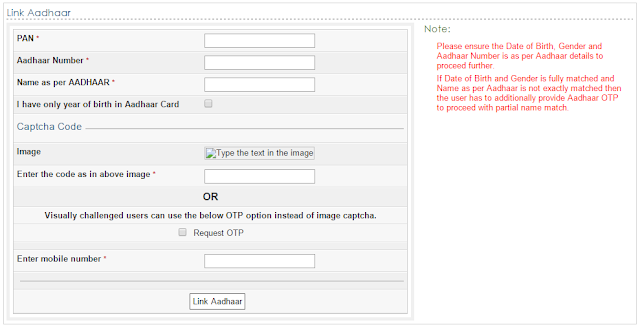

Once you are logged into the portal, go to the "Profile Settings" tab. A drop down menu will appear. Click on "Link Aadhaar". A new form will be displayed.

Details

You need to enter name, date of birth and gender as per PAN records. Next, your Aadhaar number and your name as per Aadhaar records must be entered. These details must be submitted after entering the text in the captcha code appearing on the screen.

Confirmation

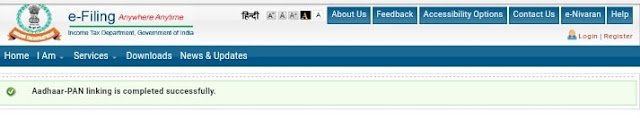

After submitting the Aadhaar details, a success message is displayed confirming the linking of Aadhaar with PAN. A confirmation email is also sent to the registered email id of the assessee.

Points to note

• Once Aadhaar-PAN is linked, one can e-verify the IT return using Aadhaar if the mobile number is registered with Aadhaar database.

• If the name in Aadhaar does not exactly match with the name on PAN, you need to additionally provide Aadhaar OTP or EVC to proceed with partial name match.

According to the latest ammendment on 9th June’2017 by the Government of India and the Income Tax Department, Every Pan Card holder have to link its Permanent Account Number with its Aadhar Number from 1st July’2017.

How to Link your Pan Card & Aadhar Card Online – Mandatory from 1st July ?

How to Link your Pan Card & Aadhar Card Online – Mandatory from 1st July ?

There are two easy methods through which Pan Card & Aadhar Card could be Linked – Online or SMS

LINK ONLINE

Follow the below 3 easy steps:

- Go to the Income tax Website – Click here

- Fill the form as per your Pan Card and Aadhar Card correctly After entering the details c0rrectly and submitting it- you will get a success notification on the next page.

- Enter the captcha code correctly / or Request an OTP by entering your mobile number.

- Aadhaar-PAN linking by SMS

- There is another easy method of linking PAN Card with Aadhaar Card. You can send one sms to either 567678 or 56161 to link your Aadhaar Card. Send sms according to the format below :

- UIDPAN< 12 digit Aadhaar> < 10 digit PAN>

Example: UIDPAN 3651323112341234 AADBFE12FF